HOUSING MARKET REPORT FOR FEBRAURY 2014

Here are the Statistics for Real Estate Transactions and Home prices for Feb 2014

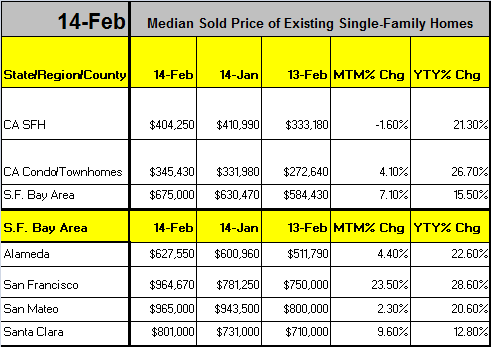

The above chart shows that the home prices in California State

are still in upward movement. The movement doesn’t seem to be as crazy as in

2013 but it is still moving upwards. The data has been separated for Single

Family Homes and Condo/Townhomes. The interesting point to note here is that even

though the SFH has seen about 21.3% increase over last year; it has seen a

decent decrease in average price about 1.6% over last month. On the other hand,

Condo/Townhomes have seen constant increase in their prices. This might be

because of the fact that there is increase in the newly built Condos and Townhouses

all over in California State and may be buyers are inclining to buy much

affordable housing than going for comparatively highly priced Single Family

Homes.

SF Bay Area is one of the areas which have consistently seen

the strong upward movement of the home prices and the trend still continues. The

average home prices are above $800K in each of the counties (Note: The average home

price in Alameda country is in mid 600’s). The Santa Clara County has seen very

big price hike, 9.6% over last month. This shows the demand for homes is growing and this is

good sign that economy is recovering and more people want to have their share

of Real Estate. This is also very good sign for sellers to come to the market and

have their profits locked in. As of today, I say and of course many analysts

say it as “sellers market”. The Spring Season is coming up and I believe its good time for sellers to come into market.

The increase in prices are also can be because of other

reason too. Before analyzing, lets take a look at the table below:

Now, the above table shows that there is decrease in number of sales both in year-to-year and month-to-month(Note: Condos/Townhomes has seen increased sales over last month). I believe the low inventory is primary reason for this less number of sales. All the counties in bay area have seen lot less sales over last year except San Francisco. This is because the SanFrancisco county have handful of inventory and this is in increasing trend. I believe this is because the home prices in this county have gone so high and more owners are coming into market to sell their homes and lock-in their profits. The other counties still see low inventory thus reflecting in the home sales. So the less supply(along with high demand) is also affecting the prices to go up. But over last month, the inventory has seen a upward trend and its a good sign for buyers as they have more homes to choose from and sometimes can have negotiating power. The Unsold Inventory Index is a very good number used to measure the health of the real estate market. It determines how many months it would take to sell homes currently on the market at the current rate of home sales. Higher is the number more likely it is "buyers market". The above table shows that these numbers have increased from last month and it shows that its going towards "buyers market". But the number itself shows its still in "sellers market". The numbers themselves are still on a lower side which says it is still sellers market but the month-to-month trend in every county shows that the market is going towards "buyers market".

This spring season looks to be very exciting season for both sellers and buyers. For sellers, the home prices are gone high and market is in sellers hand and the demand is growing and I believe its perfect time to lock-in profits. For Buyers, the good sign is that the market is moving towards buyers market and inventory trend seems to be increasing(I will post inventory data later this week in the same post) and there are going to have more choices to zero-in on their "dream" home. In some cases, this inventory increase can give buyer the negotiating power. Go grab your share.

Good Luck both buyers and sellers this Spring Season.

No comments:

Post a Comment